There are lots of observant people around who on the one hand are delighted about the strength of the US economy and the (stubborn) health of the US equity market, but on the other hand point to a number of facts that in normal times would give rise to concerns. Now fortunately it seems, we don’t live in normal times any more, hence, we can largely ignore the ‘statistics-relevant-in-normal-times’. Shall we?

Why times are not exactly normal these days: Well, the list would be very long, just to recap a few more widely known items:

Issues in financial markets and the economy

- Historically very low interest rates for a prolonged period of time, peppered with negative interest rates here and there. One may say: We have witnessed a unique historical experiment undertaken by central banks since 2008.

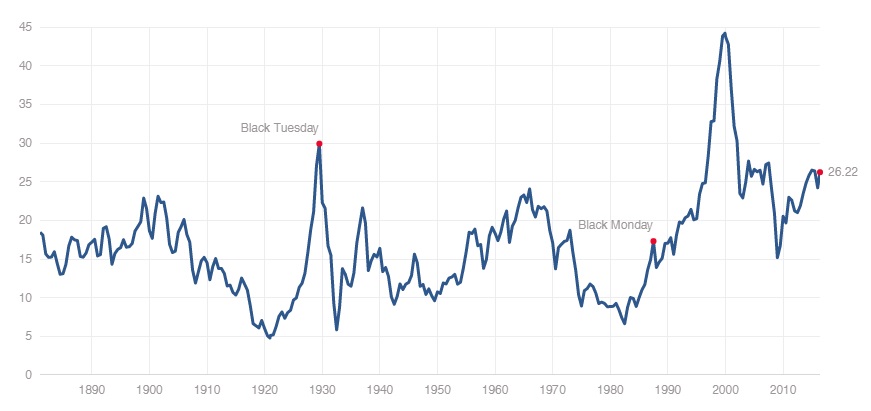

- Shiller PE ratio (or the cyclically adjusted PE ratio CAPE) today stands at 26.22 for the S&P 500. That is historically elevated and with all likelihood not sustainable.

- Oil prices are relatively low with impact on the US energy sector and Venezuela, with possible damage to the banking sector.

- Corporate debt is rather high (fuelled by share buybacks on the back of cheap money) whilst corporate profits are trending down in the US (if calculated using GAAP in contrast to pro-forma earnings).

- Central banks are feeling overly obliged to keep stock markets rising in the US, Europe, Japan and China.

Political and social issues

- Instability in the Middle East and migration crisis in Europe

- The rise of nationalism and protectionism and desires to “opt out” (see Brexit in June 2016)

- Dysfunctional politics and growing inequality leading to dissatisfaction with voters (see the race for presidential elections in the US or in Austria, May 2016).

- National armament seems to grow (e.g. US, Russia, China). On the basis of which assumptions or predictions?

Before we digress too much, back to what a few people keep looking at with an uneasy feeling – statistics and data.

Recently Stan Druckenmiller concluded at the 21st Annual Sohn Investment Conference, May 4, 2016, that the best is behind us (certainly regarding financial markets), that central banks appear to have no clear view on what the “end game” shall be, whilst markets have an “end game” when prices have deviated too much from what’s fundamentally justifiable.

As I mentioned: lots of other people are pointing to similar, very meaningful and well – sobering data, but not everybody is Stan Druckenmiller.

Here a link to a transcript of his talk which one best reads together with his presentation slides. Much recommended.

For convenience and reality check, here the Shiller PE from 27 May 2016. Historical mean stated as 16.67.

Shiller PE (CAPE), 27 May 2016. Source: http://www.multpl.com/shiller-pe/

Disclaimer: Views stated, opinions expressed or analyses provided are solely those of the individual authors as private persons and shall not be considered or interpreted as views, opinions, or analyses of any of the companies they may be liaised with, employed by or do work for.

References

[1] Druckenmiller, Stan. “The End Game”. 21st Annual Sohn Investment Conference May 4, 2016. http://www.valuewalk.com/wp-content/uploads/2016/05/The_EndGame.pdf

[2] 21st Annual Sohn Investment Conference Wednesday, May 4, 2016, Transcript of talk of Stan Druckenmiller.

http://www.valuewalk.com/wp-content/uploads/2016/05/The_Endgame_Sohn.pdf